INVOX FINANCE - Financing invoices with blockchain platform

Good night all friends, meet again with me yunita who always faithful with you all to share information related to crypto world. This time I will share information about a very interesting platform. The platform is INVOX FINANCE. For more details let's just see the explanation from me below.

Regardless of how great your business model is, how profitable you are or how many investors are interested in supporting your business, you can not survive if you can not manage your company's cash flow.

In fact, a leading study of US Bank financial services firms found that as many as 82 percent of startups and small businesses fail because of poor cash flow management. So even if you are a brilliant businessman in other ways, you should stay focused on managing your company's cash flow to avoid putting your business in imminent danger.

Weaknesses of Traditional Invoicing Financing include, for example, invalid invoices, high legal fees, disputes, and investor fraud cases. Investors have no relationship with buyers and only have information provided by sellers interested in enlightening the real situation. This exposes investors to substantial risks, and they re-tighten their requirements. Invox Finance Platform aims to eliminate these losses by making the situation transparent and trustworthy to all parties.

Invox Finance is a decentralized blockchain based platform that focuses on reinvention and reshaping traditional invoicing systems.

The platform was launched by the same team behind ABR Finance, one of Australia's leading invoicing solutions. Since 2012, ABR Finance has helped fund businesses across Australia with $ 30 million AUD in invoice financing. Now, they are trying to use that experience to bring invoicing to blockchain.

Invoice financing, by the way, is different from invoicing and financing. Traditional invoice funding is based on a buyer's invoice from the seller. In return, the financiers agree to pay money to the seller against each invoice. Buyers who purchase seller products must pay direct invoices to the financiers.

In essence, invoice financing involves purchasing an invoice at a discounted price, then hoping to make money when the client ends up paying the invoice at full tariff. It is the industry that Invox Finance is trying to annoy.

The Invox Finance platform is an invoice lending platform that disrupts the industry for US $ 2.8 trillion. Led by a star team with over $ 30 million in invoicing financing behind them, Invox Finance creates a decentralized peer-to-peer invoice loan platform that will allow sellers, buyers, investors and other service providers to directly connect, interact, share and distribute information. Currently, the invoicing industry is held by: high interest rates, lack of inter-party contact, high risk, lack of investment divers, dispute, abatement, bankruptcy. The Invox Finance decentralized platform allows dynamic invoices to be generated on ledgers distributed, benefiting all parties from increased trust, transparency, efficiency, and security at minimum cost. Invoice fragmentation allows investors to spread their risk across hundreds of invoices, enabling low-risk investments with maximum return.

Invox Finance aims to solve a number of issues in the invoicing industry today, including:

Buying invoices from the seller and funding them does not involve a direct relationship with the buyer; financiers are required to fully trust the information provided by the seller.

Because of this situation, the relationship between the seller and the buyer is not entirely transparent to the financier; the financier may have inadvertently purchased an invoice that has little chance of being paid, for example, or the seller might sell the invoice for a poorly done job.

This causes investors to have a considerable degree of risk; if an invoice is debated or disapproved, then the financial party will lose money.

HOW INVOX FINANCE WORK

Invox Finance plans to solve the problems listed above using blockchain technology to create a decentralized peer-to-peer invoiced loan platform.

The platform will enable sellers, buyers, investors, and other service providers to directly connect, interact with, share and distribute information. The goal is to create a trusted environment by facilitating transparency between parties and then rewarding performance.

Other key features will include a built-in reward system.

There will be no centralized service provider on the Invox Finance platform. Instead, the platform will be governed by a set of transparent rules run on a fully distributed ledger - like other decentralized autonomous organizations, or DAO.

BENEFITS OF INVOX FINANCE

Who will use Invox Finance? Here are some people who can take advantage of this platform:

- Investors can access higher rates of return while diversifying their investment portfolios.

- Sellers can sell invoices to accelerate their cash flow.

- Buyer may receive an extended invoice payment period and then be rewarded for verifying the invoice.

- Those who use Invox Finance do not need to know anything about blockchain. The user interface will allow payments in all major fiat currencies.

Some of the key features of Invox Finance include:

Lower Rates For Sellers:

Sellers can obtain financing at a lower price than they usually receive from traditional investors.

Investment Diversification:

Investors can access a wider range of investment products. Currently, invoicing financing investments are typically reserved for banks and finance companies. Invox Finance will allow anyone to participate in the market, making it easier for investors to diversify.

Direct Investor Access:

Sellers will have direct access to individual investors through the Invox Finance platform. This is a peer-to-peer lending environment that aims to benefit sellers and investors.

Decentralized Platform:

The Invox Finance platform will enable sellers, buyers, investors, and other service providers to directly connect, interact, share and distribute information.

Dynamic Invoice Automatic Contract:

Invox Finance will deploy "Dynamic Invoice Smart Contracts" to Ethereum mainnet. This smart contract will facilitate the creation of dynamic invoices, including invoice signing on distributed ledgers.

Smart Contract Loans:

Smart contracts for loans will also be used on Ethereum mainnet. This contract will allow the flow of funds between investors, sellers, and buyers.

Bank API Integration:

Invox Finance will integrate with banks using APIs linked to smart contracts. "The linux / python cron job will manage calls from our banking partner's APIs to smart contracts," explains whitepaper Invox Finance. "It will be hosted on Microsoft Azure cloud hosting, using" Key Vaults "for key management."

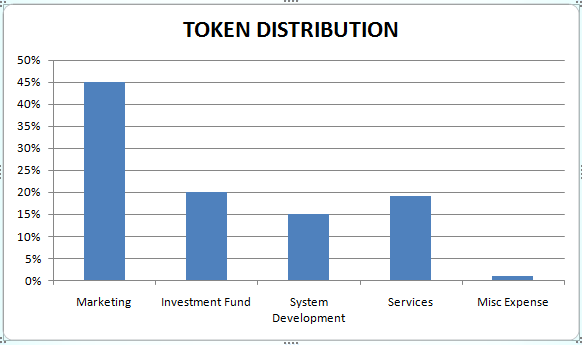

TOKEN INVOX FINANCE

Invox Token is the ERC20 token on the Ethereum blockchain. Tokens will grant access to the platform through the Trusted Members Program, then reward the work done for the platform. This system will reward buyers and sellers with Invox Tokens for invoice verification, invoice payment and settlement.

Invox Finance's smart contract is a smart Ethereum contract on Ethereum mainnet.

ICO Details Invo Finance Token:

Invox Tokens (INVOX) will be sold through ICO scheduled from March 15 to March 24, 2018.

55% of total token supplies will be distributed during ICO. There is a minimum investment of 0.1 ETH required.

Token Types: We consider our token is not a security due to its utility and consumptive token and has obtained qualified legal advice regarding our token.

Token Ticker: INVOX

Emission Rate: No new coins will be made after ICO.

Total Supply: 464m Invox Token

Network Token: Ethereum (ERC-20)

Distribution: Token will be distributed after the token sale expires.

Token Value: 1 ETH = 10,000 INVOX + any bonus

Locking: No lock-up bonus below 100ETH

BONUS

Stage 1: 3/04/18 up to 28/04/18 BONUS: 20%

Stage 2: 29/04/18 to 19/05/18 BONUS: 10%

Stage 3: 20/05/18 to 09/06/18 BONUS: 5%

Stage 4: 10/06/18 until ICO concludes BONUS: 0%

TEAM

ROADMAP

Stage 1

Invest A $ 500,000 in cash as capital

Create an early community

Develop a whitepaper

Be prepared to do ICO

Define the system framework

Dynamic Invoice Contract Autoresponder Engineer

Phase 2

Develop MVP

Conducting ICO

Stage 3

Complete MVP

Start user testing to ensure the release of quality products

Thus information from me related to INVOX FINANCE platform, Hopefully useful and can help you in making decision to become part of INVOX FINANCE.

FOR FURTHER INFORMATION AGAIN, PLEASE VISIT LINKS BELOW:

WEBSITE: https://www.invoxfinance.io/

WHITEPAPER: https://invoxfinance.io/docs/Invox-Finance-Platform-White-Paper-Version-1.03-24-Jan-2018.pdf

ETH: 0x79ab31AD412f95e8DA691F066f27d0Bc2736aCDC

Komentar

Posting Komentar